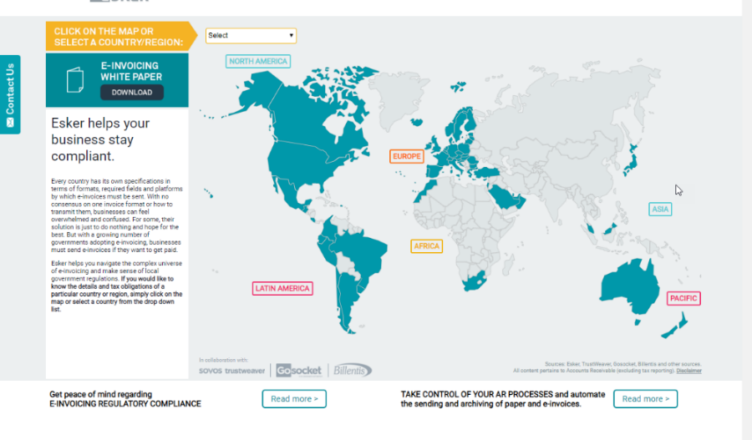

Stay informed on the ever-changing e-invoicing market! As a worldwide leader in AI-driven process automation solutions, Esker helps your business stay compliant

COUNTRY UPDATES

EUROPE

CYPRUS – B2G e-invoicing will become mandatory starting 1 January 2022 through the PEPPOL network.

FRANCE – The French government published further details on its upcoming e-invoicing mandate and decided to postpone the deadline by 18 months. Learn more

• July 2024: large businesses must issue e-invoices and all businesses must accept e-invoices

• January 2025: mid-sized businesses must issue e-invoices

• January 2026: the above applies to all remaining businesses must issue e-invoices

ITALY – As of January 1, 2022, Esterometro will be replaced by e-invoicing to the SDI platform. Starting on this date, Italian VAT businesses will have to declare every invoice sent or received outside Italy to the SDI platform. Learn more

LATVIA – The Latvian government approved a report prepared by the Ministry of Finance on the implementation of a country-wide e-invoicing system, applying to all B2B and B2G transactions starting 2025 utilising the PEPPOL framework.

POLAND – The Polish government adopted a new law introducing an e-invoicing mandate. Starting January 2022, the KSeF new e-invoicing platform can be used on a voluntary basis. After a one-year pilot project, B2B e-invoicing will become mandatory as of January 2023. Learn more

PORTUGAL – Public administrations will accept B2G e-invoices in PDF format until 31 December 2021. Official Decree

ROMANIA – Tax administration introduced a new e-invoicing system that will go live in November 2021 on a voluntary basis. Clarifications are expected and will likely include a timeline for the enforcement of this new mandatory e-invoicing system.

SLOVAKIA – The Ministry of Finance plans to introduce an e-invoicing clearance system by 2023 (voluntary basis).

SPAIN – The Ministry of Economic Affairs and Digital Transformation in Spain has published a preliminary draft law expanding the obligation to issue electronic invoices to all companies and freelancers. Learn more

AFRICA

EGYPT – According to a newly published decree, starting 15 December 2021, joint-stock companies and investment companies in Cairo are required to join the e-invoice system (affecting more than 3000 companies, identified and published by the Egyptian Tax Authorities). By April 2023, the government plans to extend the requirement to all B2B invoices. Learn more

STAY 100% COMPLIANT WITH ESKER!

Esker ensures e-invoicing for your accounts receivable and accounts payable processes in more than 60 countries around the world. Contact us

For details on each country supported by Esker, our interactive map

will help you navigate the complex universe of e-invoicing.

Check out our map